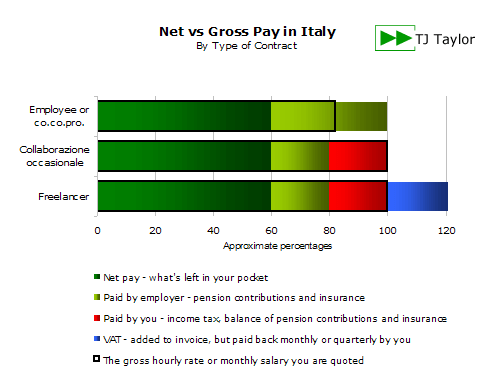

In Italy you are normally quoted gross rates, whether per teaching hour or per month, but there is a substantial difference between the gross figure at the top and the net figure at the bottom of your payslip (or invoice, if you are freelance).

Calculating what you will have left in your pocket from any given gross salary can be very complicated, but the following are some benchmarks and rules of thumb to give you a good estimate, based on 2019 tax rates.

It is worth noting that Italians use a monthly rather than annual salary as a point of reference. The average gross salary in Italy for a teacher is €1,711 (based on the World Salaries website), though the average salary in the private sector can be lower after taking into account the slower holiday periods, which are effectively 2-3 months a year.

The percentage difference between your gross and net salary depends on which type of employment contract you have: 1) if you work freelance or are an independent teacher with a ‘collaborazione occasionale‘ contract or 2) if you are an employee or staff teacher. For a more detailed explanation of the meaning of these contracts please refer to the FAQ on the different types of employment contracts for teachers.

The first category pays all contributions and taxes in full from their gross compensation (the thick black line above). The second category pay only a share of their pension and insurance contributions (currently a third, plus their income tax) from their gross salary, and their employer pays the rest.

“To cover the extra taxes your hourly rate as a freelancer needs to be substantially higher than as an employee.”

This means that the hourly or monthly rate as a freelancer should be substantially higher than with an employee contract in order to cover the share of contributions that would otherwise be paid by the employer (and which are not included in an employee payslip as they are over and beyond the gross salary).

1. Employees and staff teachers

With an employment contract, for typical English teacher salaries in Italy, you deduct between 24% to 30% from the gross to get the net salary. This is ignoring any possible deductions for children or medical bills, but includes all regional and income taxes and the employee’s share of pension and accident insurance contributions.

This percentage jumps substantially (to 35-42%) once the gross salary clears the €2,000 per month mark due to a higher rate of income tax, though this level of salary is quite rare for teaching jobs in Italy.

Your employer will file your tax declaration, but if you have substantial medical bills that are tax deductible, or if you have had more than one employer during the year, you will need to file a separate tax return – your total income from both contracts might push you into a higher income tax bracket so you will need to pay the difference.

“If you have worked for more than one school during the year, you will need to file a tax return.”

To help you interpret and follow the various taxes and deductions there’s also an example payslip at the bottom for reference.

2. Freelancers and occasionale

For a freelancer or a teacher with a ‘collaborazione occasionale‘ contract the calculation is both easier and more difficult – more difficult because there is more than one tax ‘mechanism’ to chose from according to your projected income and expenses, which is best explained and advised on by an accountant, and easier because all of the taxes and contributions are paid in their entirety by you.

Leaving aside any possible tax deductible expenses, which are normally quite low for a teacher, and after paying back the VAT, for typical teacher salaries you deduct between 42% to 49% from your gross earnings to calculate net income.

However, the precise net figure can be quite fuzzy and unclear until the year after due to the deferred payment of some taxes, the advance payment of others, and withheld tax payments by your clients.

If you want to do these same calculations in the opposite direction – to calculate gross income from a net salary – a common mistake is to add (for example) 40%, instead of actually dividing the net by 60 and multiplying by 100.

How to file your tax return

Freelancers almost always use an accountant (called ‘commercialista‘ in Italian, or a ‘ragioniere‘, closer to a book-keeper), which will cost from several hundred to several thousand Euro.

Employees who have more than one source of taxable income, or independent teachers with a ‘collaborazione occasionale‘, can also use a CAF (Centro di Assistenza Fiscale).

CAFs are by far the cheapest option, charging a nominal fee to check your documents, fill out the tax return, and transmit it, and the service is free if you complete the form yourself and need them just to transmit it. You can find your nearest centre with a quick search.

“Your local CAF is the best option and will charge a nominal fee to check, complete and file your tax return.”

The tax deadline is normally late April if you submit your return through your employer, or late May if you use a third party. The type of tax return you need is normally the 730, and the Unico form is if your tax affairs are complicated.

Learn more:

- How to Find a Good School

- Qualifications and TEFL Certificates

- How and Where to Find a Teaching Job

- Independent or Freelance Teacher?

- Understanding Visas and Permits

- Guide to Employment Contracts

- Payslips and Common Italian Terms

- Return to main FAQs page

Are you interested in teaching English with us in Italy?